Financial Leadership to Show You the Way

At The Herring Group, we’re committed to bringing financial leadership to your landscape business to improve profit margin and create space for healthy life margin. As an owner, most of the financial decisions fall on you. We’d like to help make those decisions simpler. We provide a framework for your business and make the data relevant and actionable by other people in your company. We bring simplicity to complex reporting and provide impartial, accurate data for more strategic decision-making. So you can get on with your business and your life.

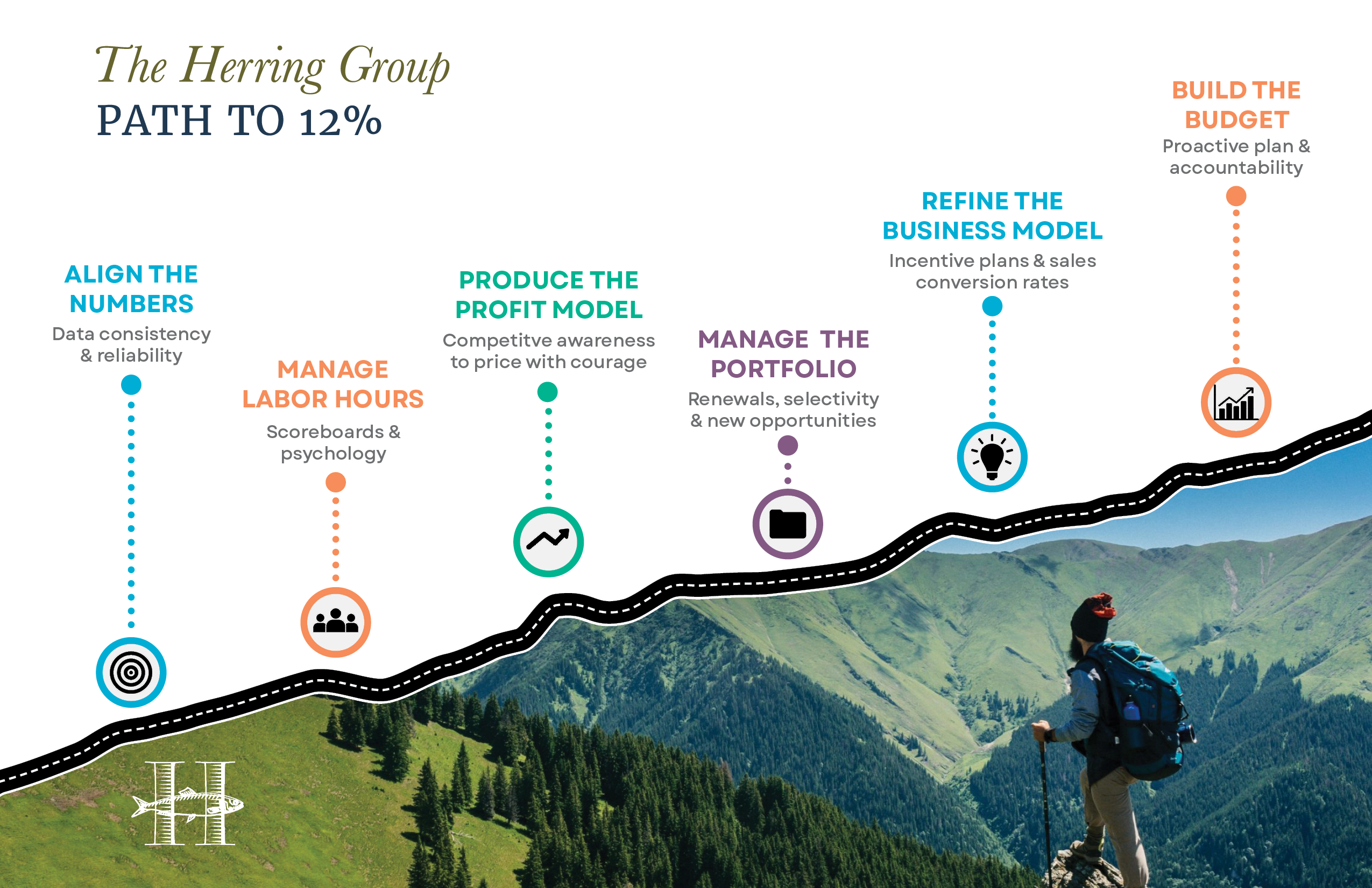

What is the Path to 12%?

The landscape industry average is only 6.1% profit. What if your company could double that?

Our customizable, proprietary system is designed to help you do just that. We take our integrated operational model, our CFO-level financial analysis, and strategic and tactical implementations to put you on the path to achieving 12% profit.

Life margin is a welcome bonus that allows owners more time and energy to positively impact their families, communities and the lives of their employees.

How Does it Work?

While the framework and business challenges are similar across many landscape industry companies, we walk alongside your team to customize the work to fit your specific pain points, culture and goals.

Align the Numbers

Ensuring data in Aspire, BOSS LM, or even “bidding spreadsheets” reflects current and historical financial reality

Manage Labor Hours

Using reports, scoreboards and psychology to increase visibility and push accountability down into the organization

Produce the Profit Model

Understanding the operating profit margin of each division, developing business strategies based on data, and bringing a competitive awareness to price with courage

Manage the Portfolio

Strategically reviewing the most and least profitable customers to approach renewal and new contract pricing with a more informed view

Refine the Business Model

Analyzing sales conversion rates, developing incentive plans, and answering strategic questions

Build the Budget

Proactively constructing the budget using an unconventional and efficient process and developing sales quotas to increase accountability

We use our 3-C approach to meet your goals.

Consultant

More than a CFO. More than a COO. We integrate our deep financial expertise, operational leadership, change management theory, psychology and behavioral economics into your business to streamline processes and achieve results more efficiently and effectively. We aim for comprehensive, executive-level strategy and implementation.

Coach

First, we want to understand your goals: for you personally and for your company. Then we customize our process to help you reach those goals. Finally, we work with your management team to help them develop the courage to make positive changes to reach those goals.

Contractor

Instead of just telling busy people what they need to do, we do some work as a member of your team. Specifically, we build custom tools and reports that can help individuals evaluate their performance, make decisions, and accomplish goals. We create the tools and reports and train people how to use them.

Interested in learning more about the Path to 12%?

Path to 12% FAQs

You may still have questions if this is the right path for you and your landscape business. Here are a few answers to some of our most commonly asked questions.

Which companies benefit most from the Path to 12%?

The Herring Group can bring value to any landscape industry business, but we’ve found our business owners benefit most from The Path to 12% if they align with the following:

- Currently using Aspire, BOSS LM, LMN or a similar landscape software

- Desire to grow for better positioning in a competitive market

- Yearning to get out of the weeds and move away from decisions based on gut instinct

- Considering a sale, an acquisition or a merger

- Motivated to make changes that can positively impact their business

What does "financial leadership" mean?

Your company is successful because you, the owner, play the role of financial leader. You determine the labor cost. You set pricing. You set the sales budget. You review the income statement and balance sheet. You monitor estimated to actual performance. Here are two questions to consider:

- Did you start a landscape business so that you could become a financial leader?

- Is being a financial leader the most profitable way to spend your time?

Because we are a team of accomplished financial leaders, we bring simplicity to complex reporting and lay out the numbers in impartial, factual reports to help you make more strategic business decisions. Our CFO-level lens allows us to make numbers relevant, interesting and actionable to business owners, executives and operational managers. As financial leaders, we prepare and review the right data at the right time with the right people in the right format.

Financial leadership makes the owner’s life better and gives the company a competitive advantage.

What does success look like?

We like to measure your success in terms of profit margin and life margin. Margin is simply the excess. Net profit margin is the excess of revenue over expenses, and life margin is the excess of time and energy available for YOU, the owner.

Does my company have to use Aspire, LMN or BOSS LM software?

While the Path to 12% works with any software, results occur faster with a landscape industry ERP system like Aspire, LMN or BOSS LM. The Herring Group knows both systems and relies on the data in those systems to produce accurate and actionable reports which facilitate accountability throughout the landscape company.

With Aspire, The Herring Group also offers data warehouse options where we create and email key dashboards and reports to managers and executives on a scheduled basis. Custom development is also an option.

Will your team replace my current Controller or CFO?

The Herring Group fills the gaps in strategic financial leadership. We hire experienced CFO-level talent and equip them with our proprietary process. We supplement the existing team, not replace it. Because of our work with dozens of landscape companies, often we accelerate the progress your team would make on its own. And because we also do some of the work, we take some pressure off of your existing team.

Conversely, you do not need to already have a financial leader in your organization – many times it’s the owner who makes these decisions. We simply take the initiative on strategic financial matters, which allows the owner to focus on other projects. Greater life margin starts almost as soon as we begin, as the owner sees he or she can trust us to provide financial leadership.

Does my data need to be cleaned up before we start?

No. We find this is one area where people get stuck, so our first order of business is typically helping you align your numbers so that your data in your system – whether that’s Aspire, LMN, Boss LM or another software – and the data in your accounting software (e.g. QuickBooks) agree and reflect financial reality. We help you trust your own data so you can make better decisions moving forward.

Why Choose The Herring Group?

Financial Leadership Means More for You

Whether they know it or not, in most landscape companies, the owners fill the role of financial leaders. Most owners that we know do not enjoy that role. We do. We are designed to fill that role.

In addition, we have an unfair advantage. We see inside dozens of landscape companies, both small and large. We put our experience and knowledge to work for you, helping you achieve your goals.

With the knowledge of your goals, we can lead in financial matters. You do not have to manage us.

What are you going to do with your free time? We suspect you will put it to good use – growing your business, developing people, working on the company culture or having more time with your family and friends.

So What’s Next?

Are you ready to see if We’re a match?

Let’s get to know each other.