This article originally appeared on LandscapeManagement.net on March 19th, 2025. Greg Herring regularly writes for Landscape Management, providing financial analysis and insights tailored to landscape business owners.

An industry executive recently told me that the problem for BrightView management is that they do not need to execute just one turnaround. They need to execute 200 turnarounds. Do not take those numbers literally, but think about the point he is making. BrightView has 180 maintenance branches in addition to some construction branches. Each of these branches serves a market. If the branch is struggling, the branch needs a turnaround. The turnaround needed is local, not national; it will depend on hiring new people at the branch and restoring the branch’s reputation in the community. That effort takes time.

In a recent earnings call, BrightView CEO, Dale Asplund, said, “From a broader perspective, we’ve come a long way in our journey of transforming BrightView, but I want to be crystal clear. We are still in the early stages of the transformation.”

As always, I want to highlight some information that many landscape business owners will find relevant to their business strategy. I am optimistic that smaller companies will be able to compete and win against BrightView in their local markets. With that said, I am hoping BrightView’s transformation succeeds because it will be great for the industry.

I have written two other articles detailing BrightView’s turnaround strategy. You can find them here and here.

At a high level, BrightView’s turnaround strategy has three areas of focus:

- Becoming the employer of choice, particularly for frontline workers. BrightView is rapidly moving to newer vehicles and mowers. It is also focusing on specific actions to retain employees.

- Serving the customer well.

- Using its size as a competitive advantage. It is an open question whether size can be much of a competitive advantage in this industry.

Here, I will provide some details on BrightView’s capital expenditure strategy and its revenue growth strategy.

Capital Expenditures

BrightView has significantly increased capital expenditures. For example, BrightView had capital expenditures of $58.7 million in the quarter that ended Dec. 31, 2024, as compared with $10.1 million in the year earlier quarter. There may be two reasons for this strategy: It makes good sense operationally and it makes their earnings before interest, taxes, depreciation and amortization (EBITDA) margin higher. Landscape companies are typically bought and sold at a multiple of EBITDA. Purchases of equipment and vehicles are capitalized and expensed through depreciation. EBITDA margin is EBITDA divided by revenue.

Why does it make good sense operationally?

- It improves employee morale, reducing turnover and increasing efficiency.

- It reduces complexity of operations — fewer breakdowns in the field and less time dealing with vehicle and equipment logistics.

Why does it make their EBITDA margin higher?

- First, the savings based on the potential operational savings noted above should provide a “real” increase in the EBITDA margin.

- Second, since BrightView is going to replace its vehicles and equipment (largely mowers) at a much faster rate, its depreciation expense (not included in EBITDA) will likely increase, and its repairs and maintenance expense (included in EBITDA) will likely decrease. In this scenario, EBITDA and the EBITDA margin will increase, which could make BrightView appear more valuable, although the fundamental economics probably have not changed. For reference, repairs and maintenance expense averaged 2.7 percent of revenue in The Herring Group 2024 Landscape Industry Benchmark report.

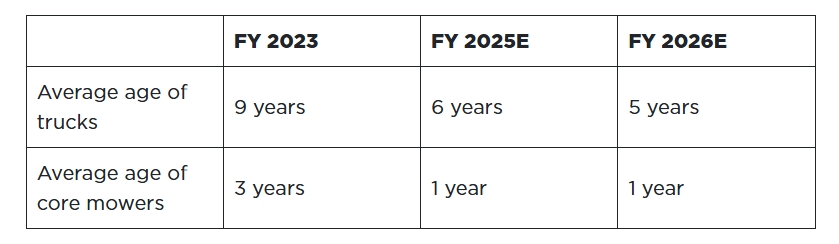

Here are some statistics showing the actual and planned age of BrightView’s vehicles and equipment:

Here’s an interesting statement by a BrightView customer that may be worth pondering as you think about your company’s fleet: “The old trucks you previously brought on-site didn’t match what our hotel stands for.”

Revenue Growth Strategies

Interested in growing your company’s revenue? The good news is you can use every strategy that BrightView is using but one. No doubt many of you are already using these strategies because they are foundational strategies for growing landscape companies; there is no rocket science here.

Customer Retention. It is easier and more profitable to grow if you retain your existing customers. BrightView has struggled in this area. The following data shows BrightView’s customer retention statistics.

- 2018: 85 percent

- 2019: 84 percent

- 2020: 83 percent

- 2021: 83 percent

- 2022: 80 percent

- 2023: 79 percent

- 2024: 81 percent

The following table shows a breakdown of customer retention at BrightView’s 180 maintenance branches:

- 20 percent of branches: >90 percent

- 40 percent of branches: 80-90 percent

- 20 percent of branches: 70-80 percent

- 20 percent of branches: <70 percent

If the average is 81 percent, then the retention rate for the companies in the bottom 20 percent must be really low.

Interestingly, BrightView showed a correlation between frontline voluntary employee turnover and customer retention. In 2024, the quartile of branches with the highest employee turnover had a customer retention rate of 78 percent. The quartile of branches with the lowest employee turnover had a customer retention rate of 84 percent — still below BrightView’s target of 90-plus percent.

Route density: BrightView is using software tools to target potential customers near its current customers to build route density, which reduces the cost of travel time as a percentage of revenue — a great way to improve profitability (operating profit as a percentage of revenue).

Converting construction customers to maintenance customers: In 2023, BrightView converted less than 10 percent of its construction customers to maintenance customers; its goal is 70 percent.

Snow contract strategy: BrightView has a near-term goal of getting its fixed-price snow contracts to approximately 75 percent of its annual snow revenue. It wants its revenue to be more predictable — probably because it is a public company.

Tree business: In California, the tree business represents about 10 percent of BrightView’s California maintenance revenue. BrightView intends to increase the penetration of its tree business in the rest of its markets — representing a $100 million opportunity.

Sales of ancillary services: BrightView’s perspective is that higher retention means better relationships with customers, which means the customers, will spend more on additional out-of-contract services — (what BrightView calls ancillary services).

Here are some interesting statistics that show ancillary services revenue as a percentage of contract revenue:

- Contract tenure: < 1 year 25 percent

- Contract tenure: 1-3 years 40 percent

- Contract tenure: 3-5 years 55 percent

- Contract tenure: 5-plus years 62 percent

There is no question that the statistics above show correlation. Causation is an open question for you to decide. Other variables could include location and the type of customers that stay longer term. With that said, growing ancillary services as a percentage of contract revenue is always a great way to grow revenue and profitability.

National accounts: For the first time in many quarters, BrightView is touting its national network of branches as a means to grow revenue by selling to customers with properties in multiple locations in the country.

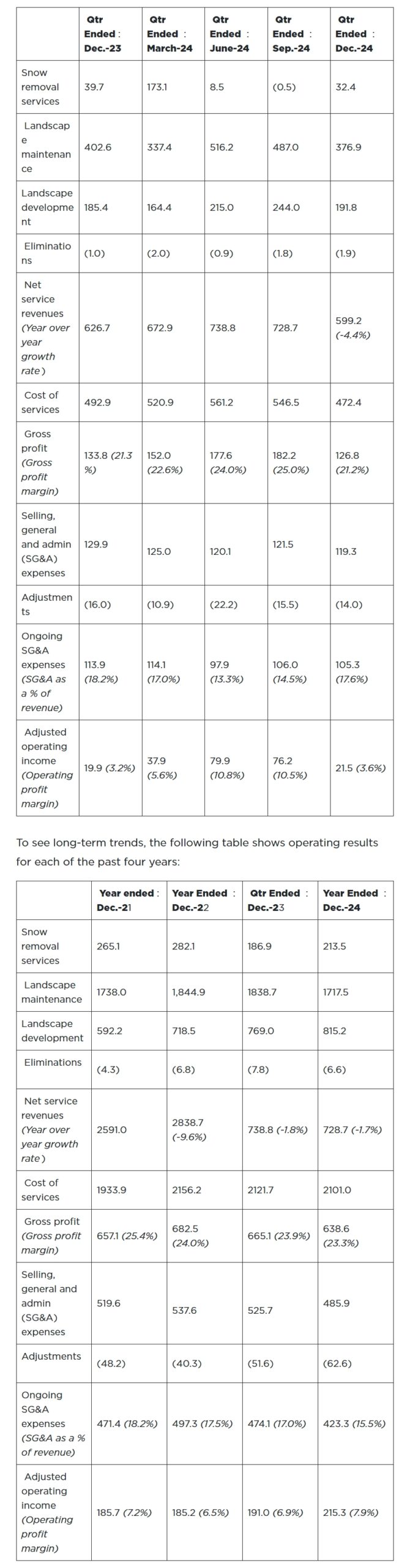

Income statement summary: In its public reports, BrightView “adjusts” its earnings before interest, taxes, depreciation and amortization and net income for certain expenses. I have used some of these adjustments for operating income in the tables below. The idea is that these expenses are not part of ordinary operations. Historically, the adjustments included expenses associated with business transformation and integration, becoming a public company and defending shareholder lawsuits, paying some employees partially through equity-based compensation and some other unusual expenses. The company also made an adjustment for COVID-19 related expenses. In the table below, I did not adjust the results for COVID-19 expenses because they are a normal part of operations for landscape companies.

For the accounting experts: Note that I have excluded from operating income the expense related to the amortization of intangible assets that were recorded as BrightView acquired other businesses and the gain on divestiture. Since most landscape companies do not have these items, I have excluded them so management teams can compare their numbers to BrightView’s numbers.

Beginning in the quarter ended March 31, 2024, the sale of U.S. Lawns and the discontinuation of BrightView Enterprise Solutions make it more difficult to compare BrightView’s current financial results with its historical financial results. For example, in the quarter that ended Dec. 31, 2024, the sale of these entities caused $20 million of the $26 million reduction in landscape maintenance revenue from the quarter ended Dec. 31, 2023.

To see short-term trends, the following table shows operating results for each of the past five quarters: